Stock Intrinsic Value 1.2

Continue to app

Paid Version

Publisher Description

It is generally through a stock price-earnings ratio to determine whether it is worth the purchase price, but there is a big problem, price-earnings ratio does not reflect the pace of development of an enterprise, can only reflect its current profitability, it can not fully reflect a stock value.

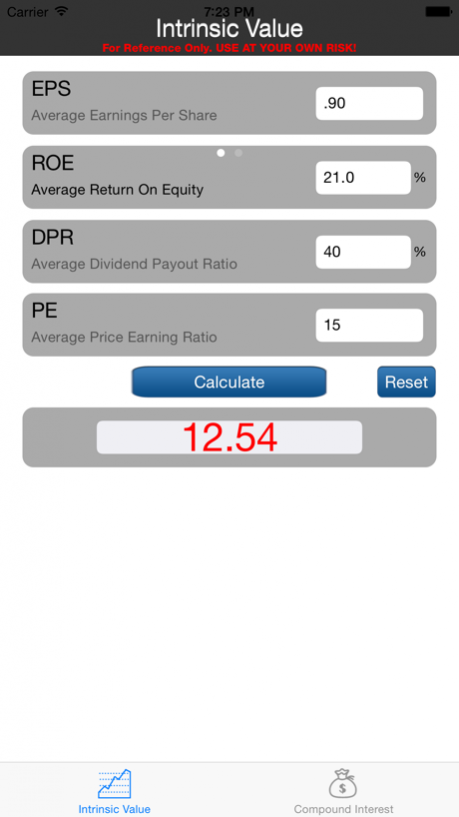

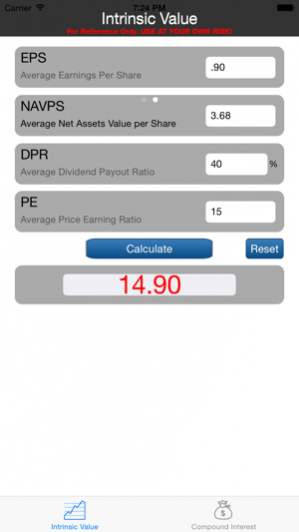

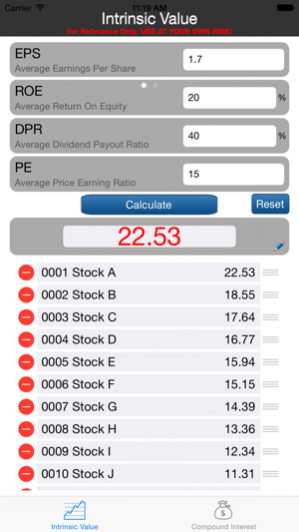

Stock Intrinsic Value Calculator is based on the book "Buffettology", that lets you from complicated financial calculators and a lot of tedious formula calculation.

Stock Intrinsic Value Calculator requires data input, are publicly available data on many sites can easily be found. The stock you are interested in using this valuation model to measure it, can provide a very good reference.

Of course, you might say, how about the case that stock data itself has fake? Therefore, we recommend that you look at the Price-to-Sales Ratio(P/S or PSR) of the stock, the stock P/S is too high, or the possibility of financial fraud is very large, or is pushed stock prices too high.

In practice, we should also consider a stock's capitalization, small-cap stocks rose fast (though falling fast too), but in general, if the valuation results almost, prefer small-cap stocks, in general , the proceeds will be significantly much better.

Robust stock-picking strategy : trading below intrinsic value + branding + small stock capitalization

Any stock valuation models, can not be perfect precision, but the "Stock Intrinsic Value Calculator", would be a very good reference.

“A general definition of intrinsic value would be that value which is justified by the facts—e.g. assets, earnings, dividends, definite prospects. In the usual case, the most important single factor determining value is now held to be the indicated average future earning power. Intrinsic value would then be found by first estimating this earning power, and then multiplying that estimate by an appropriate ‘capitalization factor’”. – Graham

“Intrinsic value is an all-important concept that offers the only logical approach to evaluating the relative attractiveness of investments and businesses. Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life.” - Buffett

“The calculation of intrinsic value, though, is not so simple. As our definition suggests, intrinsic value is an estimate rather than a precise figure… two people looking at the same set of facts… will almost inevitably come up with at least slightly different intrinsic value figures.” - Buffett

Buffettology:

The book, Buffettology, is a fantastic resource, primarily written by Warren Buffett’s former daughter-in-law, Mary Buffett. The co-author, David Clark, is a long-time friend of the Buffett family. Since these authors probably have some special insight into how Warren Buffet privately analyzes stocks.

Buffettology outlines a few different methods to determine the value of a stock and whether or not it is a good buy. Two of the most popular methods revolve around “Earnings Yield” and “Future Price Based on Past Growth.”

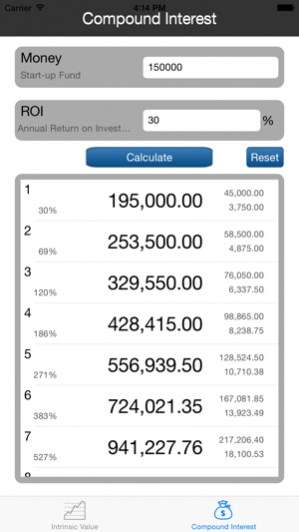

Compound interest:

Compound interest is interest added to the principal of a deposit or loan so that the added interest also earns interest from then on. This addition of interest to the principal is called compounding. A bank account, for example, may have its interest compounded every year: in this case, an account with $1000 initial principal and 20% interest per year would have a balance of $1200 at the end of the first year, $1440 at the end of the second year, $1728 at the end of the third year, and so on.

Warren Buffett is a living testimony to the miracle of compound interest - in this case with a sustained high growth rate over an amazingly long period of time. Compound interest - along with his frugal ways and unique investment skills - has made him one of the world's richest people.

Warning: For Reference Only. USE AT YOUR OWN RISK!

Sep 10, 2015 Version 1.2

This app has been updated by Apple to display the Apple Watch app icon.

Added Remark function for the stocks, you can remark the result of each calculation with stock name, code, etc. For easy access later.

About Stock Intrinsic Value

Stock Intrinsic Value is a paid app for iOS published in the Accounting & Finance list of apps, part of Business.

The company that develops Stock Intrinsic Value is Quan Wang. The latest version released by its developer is 1.2.

To install Stock Intrinsic Value on your iOS device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2015-09-10 and was downloaded 5 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the Stock Intrinsic Value as malware if the download link is broken.

How to install Stock Intrinsic Value on your iOS device:

- Click on the Continue To App button on our website. This will redirect you to the App Store.

- Once the Stock Intrinsic Value is shown in the iTunes listing of your iOS device, you can start its download and installation. Tap on the GET button to the right of the app to start downloading it.

- If you are not logged-in the iOS appstore app, you'll be prompted for your your Apple ID and/or password.

- After Stock Intrinsic Value is downloaded, you'll see an INSTALL button to the right. Tap on it to start the actual installation of the iOS app.

- Once installation is finished you can tap on the OPEN button to start it. Its icon will also be added to your device home screen.